- Sebastian Bartosiak

- Read in 4 min.

While working with insurance industry leaders, I observe their increasing interest in simplifying the time-consuming claims process. In this article, I outline the reasons why insurance company executives should invest in automation to handle the loss-making part of the business more efficiently. Additionally, I provide techniques worth adopting in such automation.

The revolution of automation

Without a doubt, the insurance industry is undergoing a transformational revolution driven by technological advances. Automation is changing the way insurers operate, increasing their efficiency in various processes, optimizing operations and improving customer service. For example, a McKinsey report states that automation can reduce claims processing costs by up to 30%!

Which areas of the insurance industry can be automated?

I would take a risk and said that almost all. In fact, I wrote more about this in an article about insurance process management and why it’s worth implementing in a company. From my experience working on several insurance-related projects, and observing the needs of our clients, automation is a great tool to simplify processes such as:

- Policy underwriting and generation

- Calculations and pricing

- Damage assessment and estimation

- Policy renewal and reminders

- Customer communication and support

- Claims Processing

For example, insurers can automate policy issuance, endorsement processing and renewal management, minimizing manual errors but also speeding up operations.

Moreover, automation has revolutionized customer service and engagement. Chatbots and virtual assistants have brought significant advances in this area. These AI-based tools enable insurers to offer personalized support, handle routine inquiries, and provide round-the-clock assistance, increasing customer satisfaction while reducing operational costs.

In addition, self-service sales channels, available 24/7, combined with automated, rapid delivery and transparency of information about product features and prices, enable customers to purchase a policy at any time without the insurer’s involvement. This increases the organization’s revenue growth opportunities.

But what about the topic of today’s article? Due to the complexity of claims processes (involving many internal and side processes, such as initial application, documentation collection and verification, investigation, claims assessment, disbursement, and others), insurers have been taking cautious steps over the years to automate this part of the business. However, with advances in technology and the increasing openness of insurers to automation, it becomes clear that there are approaches that allow such automation to be managed safely and easily. So let’s delve into these approaches.

The automation of claims processes

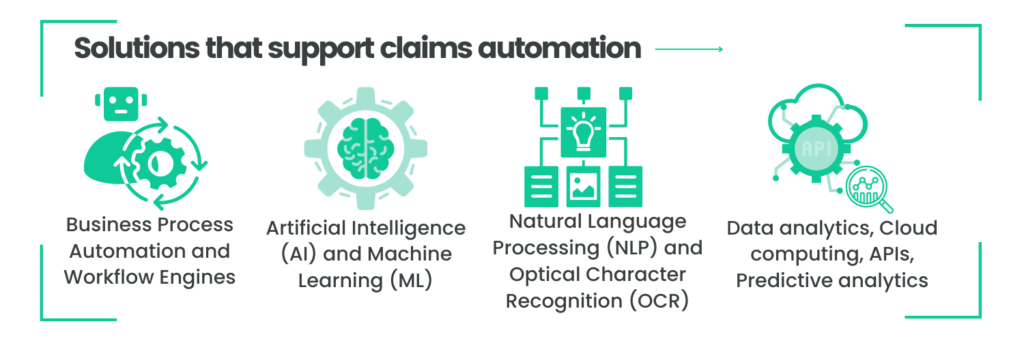

Advanced technologies like artificial intelligence (AI), business process automation (BPA), and data analytics have equipped insurers with powerful tools capable of automating various stages of the claims process.

Insurance companies now possess the means to revolutionize their claims operations. In addition to streamlining and expediting the claims’ settlement process, automation has proven to enhance accuracy, reduce costs, and significantly improve customer satisfaction.

How does the claims’ automation mechanism work?

Let’s talk about mechanisms that enable you to transform the entire claims’ lifecycle through automation, in order to streamline operations, reduce costs and improve customer service.

One notable example is the automation of motor insurance claims reporting and payment. Such a claims’ automation process involves orchestrating, integrating and monitoring the domain system with the rest of the company’s architecture. It is a good idea to leverage the power of a business process management system to proactively automate business processes. With such engines, it is possible, for example, to verify claim payment conditions using decision tables, eliminating the need for manual intervention by service personnel. But one step at a time.

Reporting

Insurance companies provide web portals or mobile apps through which policyholders can report their insurance claims. Such an automated system allows customers to enter details such as accident information, photos and supporting documents. Artificial intelligence (AI) algorithms can then analyze the information provided by policyholders, extracting relevant details and classifying the claim based on predefined criteria. This analysis helps streamline the claim process and direct it to the appropriate channels for further evaluation.

Damage assessment

This process is aided by technology of image recognition. Integrating the system with such a solution can help automatically assess the extent of damage. The system compares images with a database of known damage patterns and estimates repair costs based on historical data.

Such processes are highly secure because they are based on predefined rules. Insurance companies set rules and guidelines to determine the eligibility of compensation. For common scenarios, such as minor damage, predefined thresholds can trigger automatic compensation without manual intervention.

Once a claim is approved, automated systems can facilitate direct payment to the policyholder or service provider, minimizing manual paperwork and reducing processing time.

Fraud detection

Data analysis: Automated systems can analyze large amounts of data, including policyholder history, claims patterns and external sources, to identify suspicious activity or potential indicators of fraud. Unusual claim patterns or discrepancies can trigger further investigation by human claims adjusters.

By continuously learning from historical data, machine learning models can improve fraud detection capabilities. They can identify patterns and anomalies, flagging potentially fraudulent claims for manual review.

Summary

The revolution in insurance claims processes driven by automation brings with it a new era of efficiency, accuracy and customer focus. As insurers harness the power of artificial intelligence, machine learning and data analytics, claims settlement is becoming faster, more accurate and more cost-effective.

The transformative potential of automation in insurance claims settlement holds the promise of a future where policyholders can experience fast, transparent and seamless claims settlement, and insurers can optimize their operations and deliver exceptional customer service. The shorter the claims resolution path, the less costly the process is for the company, so insurers, you should invest in automating the process.

Check out our smart process automation services

Let us help you unlock your business operations efficiency