- Dominika Dębska

- Read in 5 min.

AI Transforming the Insurance Industry

Artificial Intelligence (AI) has been gradually making its way into the insurance sector for years, supporting various operations such as data processing, risk assessments, and basic customer interactions. However, its role was often limited to simple, rule-based systems that lacked the depth and flexibility of modern AI solutions. Today, with advances in machine learning and data analysis, AI is transforming the industry on a much larger scale.

Modern AI technologies enable insurers to develop dynamic, customer-centric solutions that were previously impossible. For instance, AI-powered geolocation analysis now allows insurers to predict risks associated with natural disasters, enabling the creation of highly tailored insurance offerings that precisely match individual customer needs.

The Transformative Potential of Artificial Intelligence

Artificial Intelligence distinguishes itself through its capacity to process and analyze complex data sets with unprecedented speed and accuracy. Advanced technologies like large language models (LLMs) demonstrate AI’s transformative power, enabling sophisticated understanding and problem-solving across multiple domains.

These intelligent systems are built on extensive datasets, providing the ability to understand, produce, and process natural language seamlessly. They function as comprehensive analytical tools, capable of handling complex problems, crafting professional documents, and performing intricate data analysis with remarkable efficiency.

Key Use Cases Driving Insurance Innovation

Claims Management: Intelligent Damage Assessment

One area that benefits the most is claims management, often referred to as “complaint management.” As it’s where insurers face their greatest financial losses. Implementing AI in this context brings immense advantages: process automation, time savings, and significant reductions in operational costs.

Consider vehicle damage analysis as a prime example. AI technologies can now:

- Instantly identify vehicle details (brand, model, year)

- Assess damage extent with high precision

- Generate immediate damage cost estimates

response = model.generate_content([image_file, """ What is the brand, model, and estimated year of this car?"""]) print(response.text) "The car in the image is a BMW 3 Series (E21) from the late 1970s, likely a 1979 or 1980 model."

response = model.generate_content([image_file, """

Is the car in the picture damaged?

Answer in JSON format with two keys: damaged and description."""])

print(response.text)

The answer is:

{

"damaged": true,

"description": "The car has a cracked windshield"

}Benefits include:

- Accelerated claims processing

- Reduced human error in damage assessment

- Optimized departmental workflows

- Enhanced customer satisfaction through rapid response

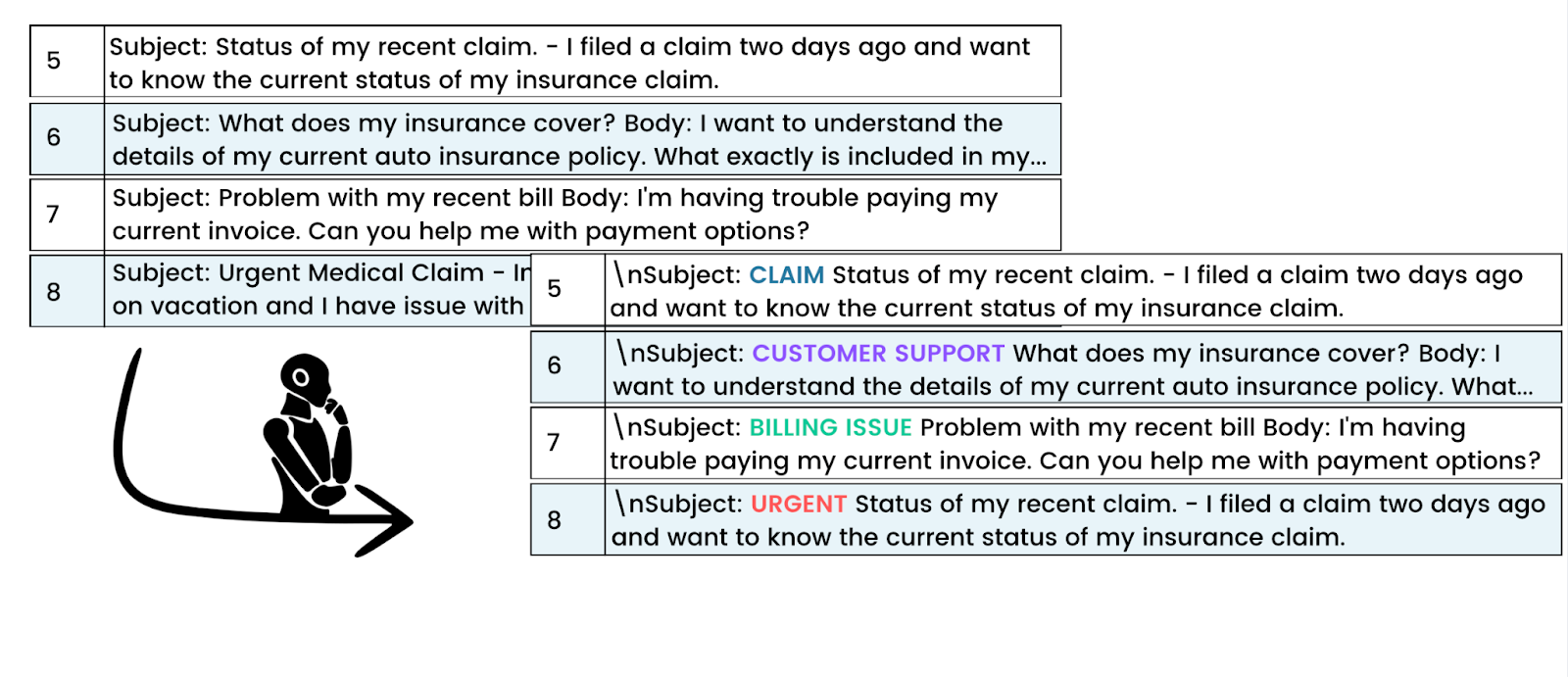

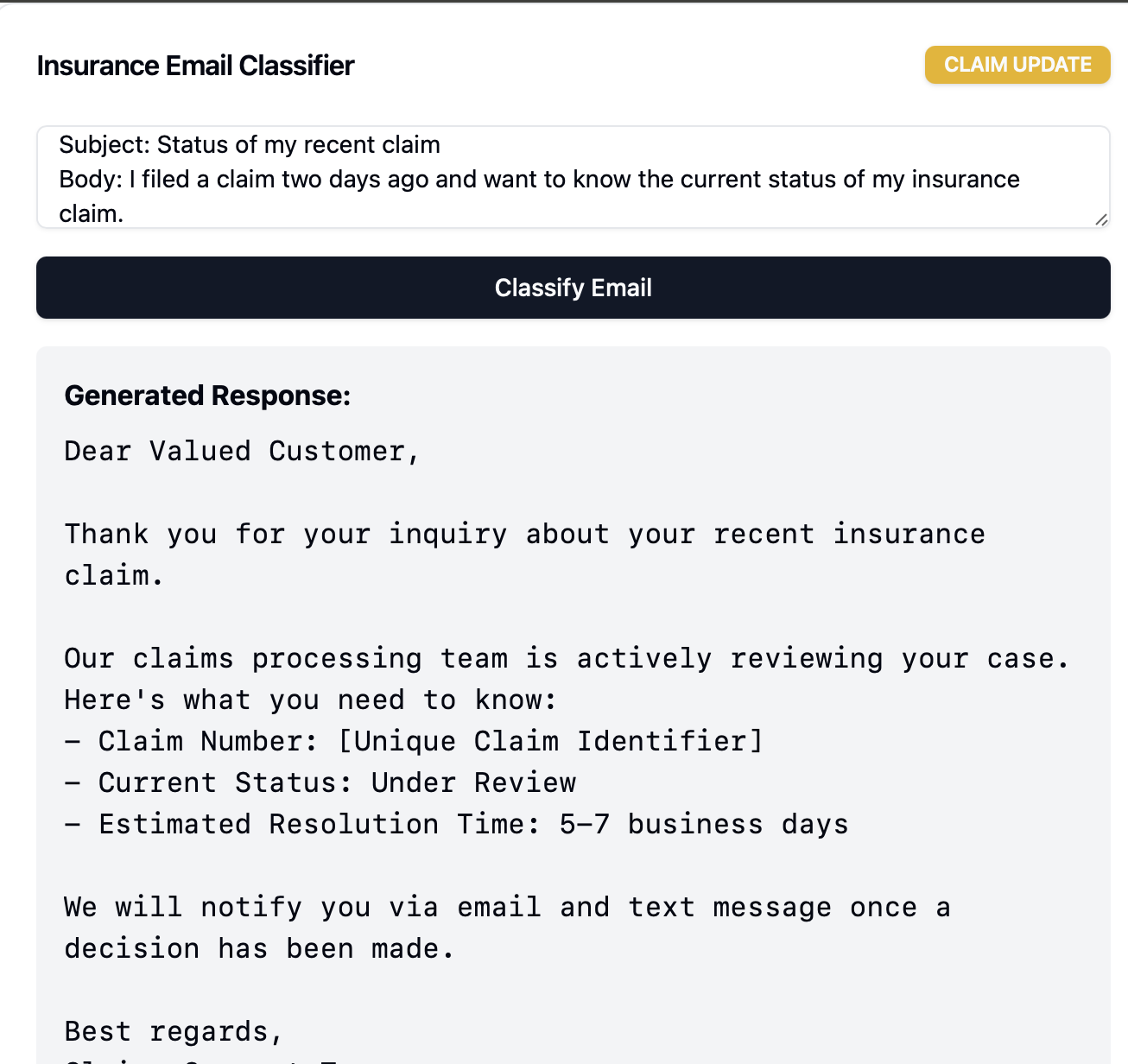

Email Classification and Management

Hundreds of emails a day from policy inquiries to billing questions, claims updates, and customer feedback, the sheer volume of emails can quickly become unmanageable. This is where LLMs can step in to streamline the process.

Imagine an application that gathers all incoming insurance-related emails into a central system. With the help of an LLM, these emails can be automatically sorted and prioritised based on their content. For example, the system might tag emails with labels like “policy inquiry,” “payment issue,” or “customer feedback.” This categorisation makes it simple to direct each email to the right department, ensuring a faster response.

But that’s just half of the story! When the issue is straightforward the system can quickly scan your internal knowledge base (such as policy guidelines or previous claim details) to generate an instant, automated response. With a Retrieval-Augmented Generation (RAG) framework, the LLM pulls in the most relevant information and creates a tailored reply, making the process even more efficient.

Then, a team member can simply verify the response before hitting send, ensuring the information is accurate and reliable. Voilà! This means faster customer support and an instant reply, even if the issue isn’t fully resolved yet. It gives the customer the impression that someone is actively working on their case. Also this solution boosts overall team productivity.

Predictive Risk Models

The use of AI for predictive analytics enables better planning and risk management. Insurers can accurately evaluate property risks by analyzing proximity to hazards like fault lines, river banks, and adverse weather zones.

Example of application: Geolocation analysis in BigQuery supports insurers in identifying potential sources of danger or risk and offering tailored insurance policies, such as flood coverage. AI-generated maps can highlight the most at-risk areas and enable dynamic premium calculations.

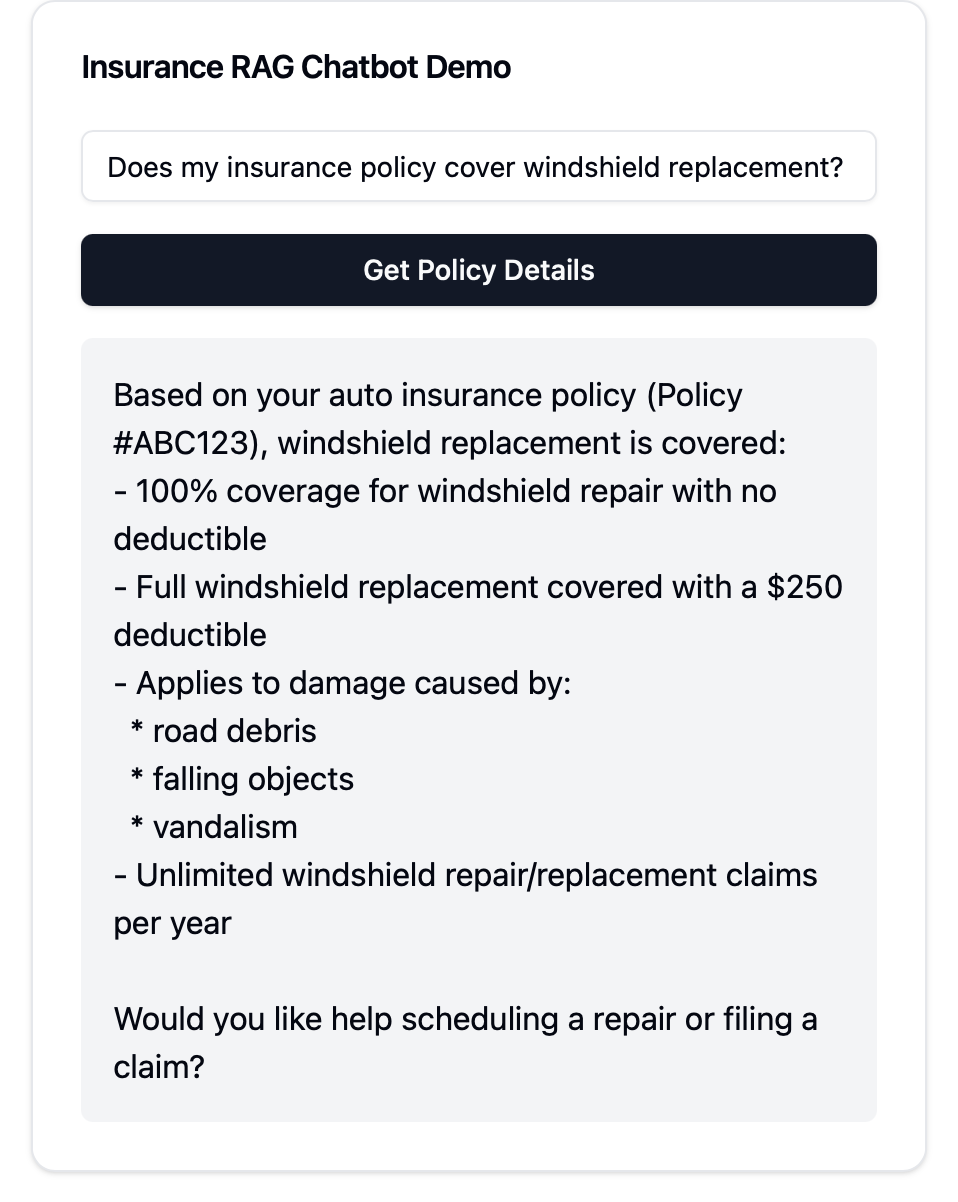

RAG: Chatbot on Steroids

I’ve mentioned RAG before, but here I want to give it more spotlight. Retrieval-Augmented Generation is an advanced AI system that combines information retrieval from vast knowledge bases with generative AI to provide highly relevant and contextual answers. Unlike traditional chatbots, which rely on scripted responses, RAG systems can dynamically pull information from real-time data sources and adapt to complex queries.

Customer Query: “Does my insurance policy cover windshield replacement?”

Chatbot Response: “Windshield coverage depends on your specific policy. Some policies may cover windshield damage, while others may not. It’s best to check with your insurance agent for detailed information about your specific coverage.”

Limitations:

- Generic and unhelpful response

- Provides no specific details

- Redirects the customer without offering concrete information

- Lacks context and personalization

- Requires additional effort from the customer

RAG (Retrieval-Augmented Generation) Approach:

On top of that RAG can provide additional information:

- Preferred auto glass repair shops in your network

- Online claim filing available through our mobile app

RAG Advantages:

- Provides specific, personalized information

- Pulls exact details from the policy document

- Offers actionable next steps

- Demonstrates comprehensive understanding

- Reduces customer service workload

- Increases customer satisfaction

A RAG-based system is significantly more dynamic and responsive compared to traditional chatbots.

Preparing for AI in Insurance: Overcoming Business Challenges

First, it is necessary to assess whether the technical debt in the underlying systems makes it possible to achieve this goal. An IBM report reveals critical obstacles to AI adoption:

- 71% of executives struggle with legacy system maintenance costs

- 52% face data constraints limiting product innovation

Before leveraging AI, assess your technical readiness:

- Evaluate your core systems

- Check data accessibility and quality

- Identify potential modernization needs

Want to navigate these challenges? Consult our experts and chart your AI strategy.

Summary

As AI technologies continue to evolve, they will become increasingly integral to insurance operations.

The companies that successfully integrate these technologies while preserving a commitment to personalized customer experiences will lead the industry’s future transformation.

Leverage the power of AI in Insurance

Implement modern data platform and become data-driven organization